Capital markets

We work with multiple financial products and services relating to the structuring and distribution of securities and derivatives transactions. Alongside Corporate Credit, we identify clients who are qualified to engage in public or private issuance to raise capital.

To meet clients’ goals and desires with quality, we offer a diversified array of personalized services that include the preparation of documents that reflect company’s journey and competitive advantages for investors. We also have a specialized team to assist clients in matters such as discussion of structures, market updates, interfacing with regulators, and procedures of hiring and managing providers of other services relating to issuance.

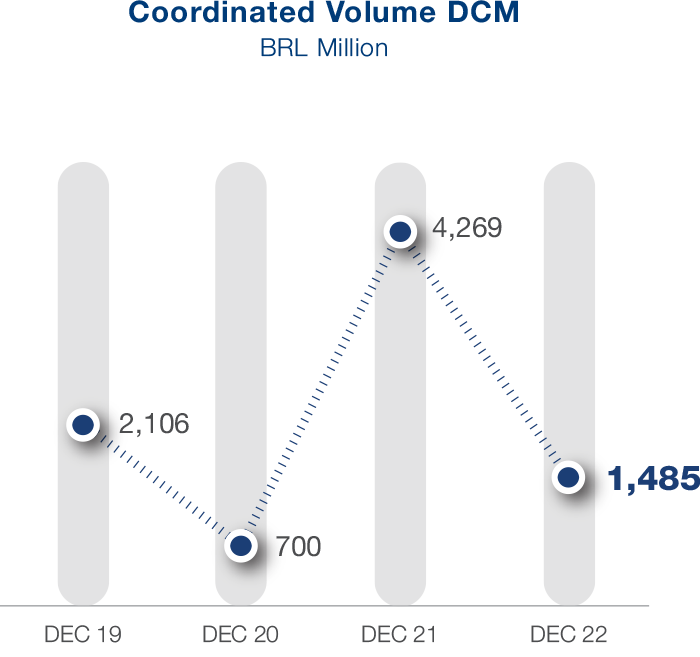

The activity has proved increasingly resilient and adaptable to the needs of our clients. We ended 2022 with growth of 8.3% in the number of offers coordinated, for a total of 13 offers and coordinated volume of BRL 1.485 billion.

Treasury

Treasury is responsible for ensuring that the bank remains liquid and for laying the basis for prices and volumes of the conglomerate’s assets and liabilities.

The department structures and prices derivatives and other products in conjunction with Corporate Credit. Its remit is to present alternatives for companies to address the market risks to which their balance sheets are exposed.

It offers derivatives for hedging against the risks associated with exchange-rate fluctuation, interest-rate variation, and swings in commodity prices and price indices, as well as various types of foreign-exchange service and management of a range of market risks.

The notional value of the portfolio of derivatives with clients rose 56% in 2022, ending the year on BRL 4.01 billion.