We offer transparency and agility in responding to demand for credit, financial services and derivatives from our target public.

With the resilience of the economies of Brazil and the rest of the world in first-half 2022, and our team’s commitment to identifying and satisfying the needs of our clients, we were able to maintain the growth of our activities and profitability.

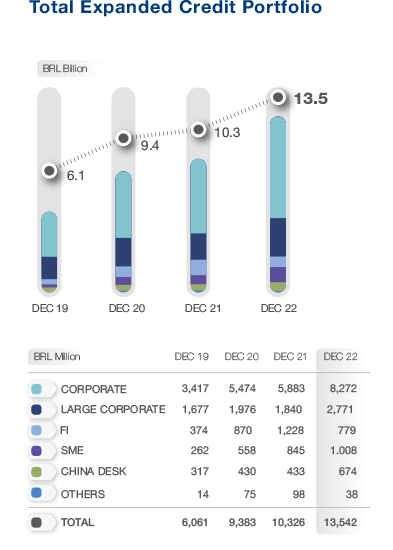

We lend to small and medium enterprises (SME), and companies in the Corporate and Large Corporate segments. We also extend credit via our China Desk. And we offer loans with a range of collateral types or security interests, as well as pre-shipment export finance.

Our year-end expanded credit portfolio totaled BRL 13.5 billion, including guarantees, letters of credit and operations bearing credit risk (issuance of debentures, promissory notes, Rural Product Notes (CPR), time deposits (DPGE) and foreign bonds). We prioritize transparency and agility in responding to our clients’ needs for credit, financial services and derivatives.