Our reputation and international recognition are sustained by the quality of our products, assets and funding sources.

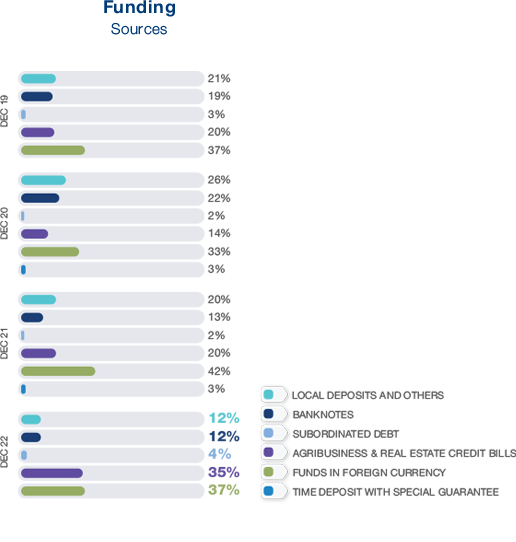

We follow a global strategy aimed at excellence and transparency in offering products with maturities that match those of our clients’ credit portfolios, diversified sources of funding and good asset structuring.

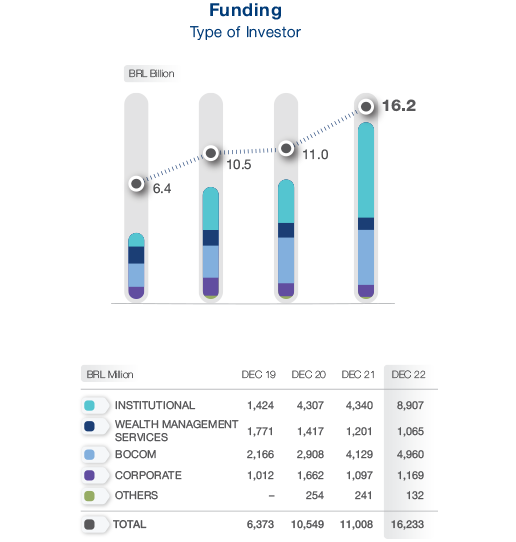

To assure the integrity and security of our financial processes in the local market, Funding and Institutional Relations works with Wealth Management Services to offer fixed-income securities to institutional clients such as banks, asset managers and insurance companies. The main types of such securities are Financial Bills (LFs), Real Estate Credit Bills (LCI), Agribusiness Credit Bills (LCAs) and Certificates of Deposit (CDs).

Financing and collateral operations on global markets play a complementary role in our funding activities. The support of our controlling shareholder, relationships with the world’s front-ranking financial institutions and access to competitive rates enable us to perform operations involving credit facilities and guarantees.

In 2022, we raised BRL 200 million in another private issuance of ten-year subordinated financial bills (LFs) paying the CDI rate plus 2.4%, consolidating the success of our Funding team.

Our operations are rated by two of the world’s leading rating agencies. In 2022, Fitch and Moody’s reaffirmed BOCOM BBM’s national scale ratings as AAA(bra) and Aaa.br, the highest on their respective scales; and BB+ and Ba1 on the global scale.

In sum, outstanding management in origination, asset structuring and identification of competitive funding sources enables the bank to fund and grow its activities under excellent conditions in terms of cost and tenor.